The Next Options Protocol with Maximized Liquidity

1000x

Leverage

No Liquidation

Narrow Spread

Grantee of

Total Trading Volume

$0

Total Contracts

0

0

Total Transaction Volume

$0

Protocol Net Revenue

$0

Become an Options Market Maker

Short-term Options LP

High risk, high return

0DTE*. 1DTE

APR

0.00%

7-day revenue

$0

Mid-term Options LP

Medium risk, medium return

near-week, near-month

APR

0.00%

7-day revenue

$0

Long-term Options LP

APR

0.00%

7-day revenue

$0

DTE* : Days to expiry

Options Exchange with Unparalleled Liquidity

Abundant liquidity to fill hundreds of order books based on real-time market data

High APR, but with Exceptional Safety

Enjoy lucrative returns safely with risk-hedging algorithm

Audited and Secured by

Backed by

FAQ

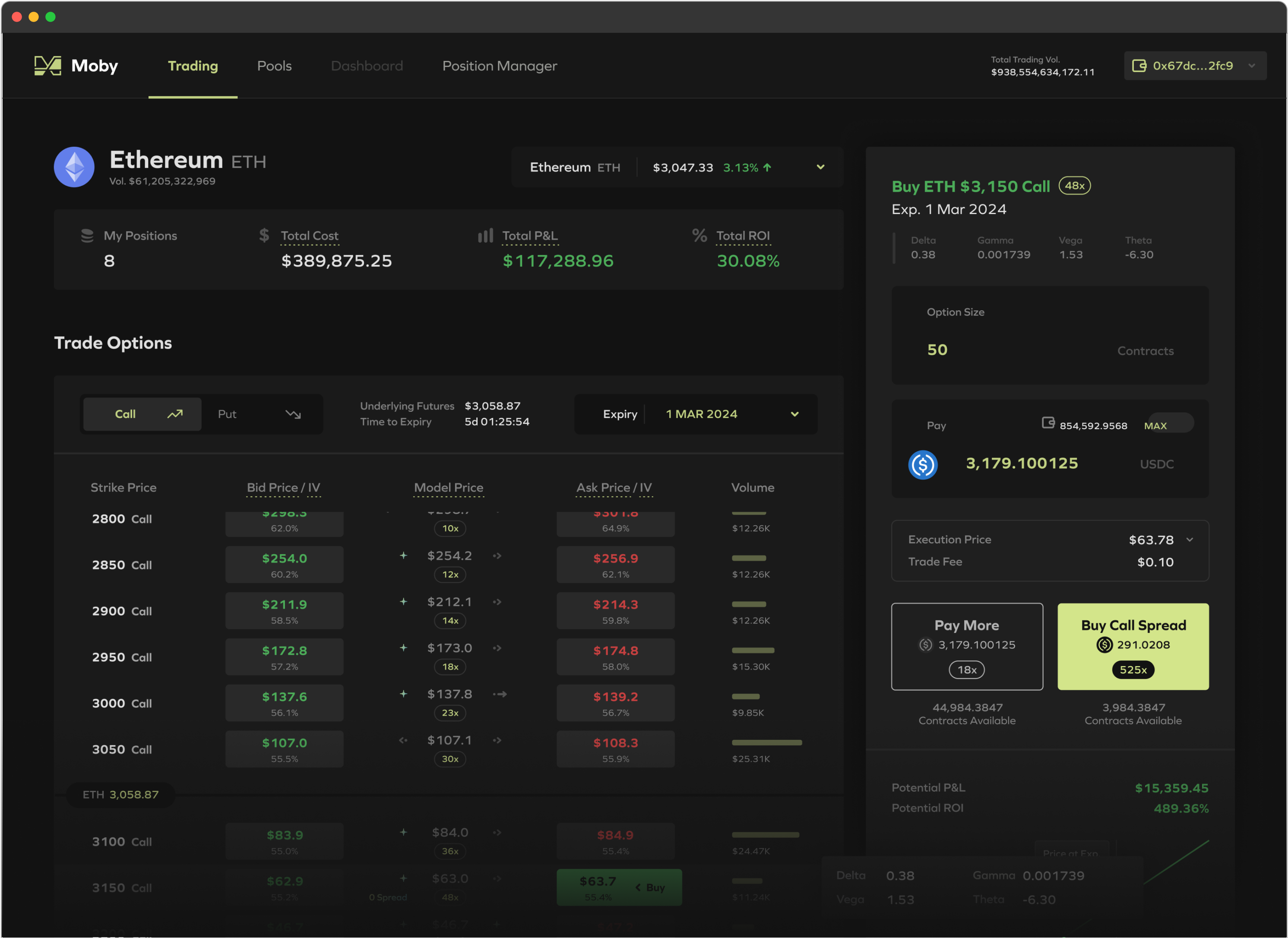

What is Moby?

Moby is an on-chain options protocol to lead the next narrative for DeFi with real-time accurate pricing, narrowest spread, abundant liquidity, and Robinhood-class UI/UX.

ㅤ•ㅤBased on newly pioneered SLE (Synchronized Liquidity Engine) as counterparty to traders, offering all options

ㅤㅤpositions — regardless of size or direction

ㅤ•ㅤAccurate options pricing based on real-time market IV and Futures data

ㅤ•ㅤDynamic Risk Premium Model based on LPs' real time Greeks risk (Delta, Theta, Vega) to provide narrow spread

ㅤ•ㅤTokenized options positions as foundational infrastructure for integration with other DeFi services, RWA, and

ㅤㅤstructured products

ㅤ•ㅤTradFi style infra (Prime Brokerage, Clearing House) to boost capital efficiency

What assets do I need to provide liquidity or trade on Moby?

For Liquidity Providers, accepted assets are USDC, wBTC and wETH.

Once liquidity is provided, there is a lock-up period of 7 days.

For Traders, Moby accepts USDC for all positions except for Short Call where underlying asset is required.

Put positions are cash-settled (USDC), whereas Call positions are physically settled (wBTC or wETH).

We plan on expanding our scope of available services to altcoins in the future.

Which wallets are supported?

Moby supports MetaMask with plans to support more wallets in the near future.

How are options different from perpetual futures? What are the benefits?

Options and perpetual futures, both derivatives, differ in several key ways:

No Liquidation

Options provide the choice to buy or sell an asset within a set timeframe, avoiding continuous exposure. Perpetual futures, on the other hand, may result in liquidation when position losses exceed margin, while options do not liquidated before expiration.

Leverage

Both offer leverage, but options provide more precise control over risk due to their defined premium. Additionally, options often offer higher leverage ratios in far out-the-money (OTM) ranges.

Risk Hedging

Options are frequently used for risk hedging, whereas perpetual futures can also serve this purpose. Generally, options offer a wider range of risk-hedging possibilities compared to perpetual futures.

Market Neutrality

Options enable market-neutral strategies, whereas perpetual futures typically involve directional bets.

Volatility Bets

Options provide specialized strategies for betting on volatility, offering traders more refined approaches.

Which chain is Moby on?

Moby is on Arbitrum Testnet and will be deployed to Arbitrum One (Mainnet) by 1Q 2024.

About The Arbitrum Foundation

The Arbitrum Foundation, founded in March 2023, supports and grows the Arbitrum network and its community with secure scaling solutions for Ethereum.

Arbitrum One

Arbitrum One is a leading Ethereum Layer-2 scaling solution developed by Offchain Labs. An Optimistic Rollup, Arbitrum One provides ultra-fast, low-cost transactions with security derived from Ethereum. Launched in August 2021, the Arbitrum One mainnet beta is EVM-compatible to the bytecode level and has 60%+ TVL in the L2 segment. 400+ DeFi and NFT projects are live in the ecosystem to date. In August 2022, Arbitrum One upgraded to Nitro tech stack, enabling fraud proofs over the core engine of Geth compiled to WASM.

Who is building Moby?

Moby is being built by a handful of talented options experts with backgrounds ranging from Web3, IT, and Finance.

What makes Moby different from CEXs?

Deep & Constant Liquidity

CEX gets liquidity from Market Makers, Moby gets it from its own pioneering SLE (Synchronized Liquidity Engine). Market Makers can also hedge their positions on Moby thanks to Moby’s everlasting liquidity provided by SLE.

Dynamic Spread

Moby incentivizes traders hedging Greeks risk by charging lower Risk Premium so that traders open such positions at better prices.

Enhanced Composability

All positions are tokenized on-chain, which can then be either used to build structured products or sold on secondary markets.

What makes Moby different from other DeFi options protocols?

Market-synced Price

Moby calculates options prices based on real-time data from CEXs and oracle instead of relying on internal models or historical data.

Risk Neutral LP

Moby constantly hedges risk by incentivizing traders on every trade that reduce the Greeks risk of OLP. If traders worsen Greeks risk, Moby charges a higher Risk Premium to protect LPs and vice versa.

High Capital Efficiency

Moby utilizes a Clearing House to net opposite positions, thereby conserving capital. If traders open both short and long positions with the same expiries, OLP can offset the positions and recover collateral, enhancing capital efficiency. Even when using different expiries, Moby can limit the payoff and maximize OLP's capital efficiency.

High Leverage & Credibility

Moby guarantees settlement with 100% collateralization. In the near future, Prime Brokerage will be added to ensure settlement while providing margin to traders.

Why does Moby's OLP APR stand out?

Options protocols typically provide a significantly higher Annual Percentage Rate (APR) compared to other derivatives protocols. This is because the fees imposed on options trading, due to the various strategies and leverage utilization, tend to be higher.

Additionally, in the case of Moby, they allocate portions of the Risk Premium paid by traders to Liquidity Providers (LPs),leading to an exceptionally high APR.

Does Moby's high OLP APR lead to traders paying higher fees?

No, Moby provides deep liquidity and dynamic spread to charge a lower Risk Premium than the spread in the order book. This enables traders to execute options trades on Moby at the best prices.

Have further questions?

Check out for more questions on Moby Docs FAQ section.

Docs

Telegram

Discord

Blog

© 2023 Moby. All rights reserved.